Services

assisting you with a formal, qualified appraisal.

Whether you are insuring precious family heirlooms, settling an estate, considering a public sale of your assets or donating your property to a charity, Harrison Appraisals, LLC can assist you with a formal, qualified appraisal.

A qualified appraisal can reduce your financial risk by providing an informed and unbiased opinion of value for your valuable personal property.

Appraisal Services

Antiques, family heirlooms, fine art and collectibles can be valuable assets. Many homeowners rely on basic “replacement cost” policies for all-risk protection against loss, damage or theft. However, they are often unaware that these policies provide exclusions for antiques, fine art, coin & stamp collections, furs, jewelry, firearms and other valuable objects.

To ensure complete replacement cost coverage for your rare and one-of-a-kind items, you must have a qualified personal property appraisal (sometimes called an inland marine floater or schedule) prepared by an accredited, USPAP-compliant appraiser. This appraisal should be filed with your insurer.

We specialize in providing appraisals for purposes of insurance replacement and reproduction cost. If you are the victim of a theft or a natural disaster, or if you have experienced a loss resulting from a recent move, we are available to assist you with a retrospective replacement cost appraisal for your insurance damage claim.

As part of the probate process, personal representatives and executors in many states (including Maryland, Pennsylvania, Delaware, Virginia and the District of Columbia) are responsible for identifying and submitting an inventory of all tangible assets owned by a decedent at the time of death. This requirement pertains to all real estate and personal property. In many cases, an inventory of assets must be submitted no later than three (3) months after the estate is opened. Certain states—including Maryland—also require specific inventory reporting formats with which the personal representative must comply.

If these requirements are met in a timely manner, the decedent’s estate could be challenged and the probate process could be delayed.

We are experienced in providing fair market value personal property appraisals for purposes of completing the probate process and determining state inheritance and/or estate tax liability. As IRS-qualified and accredited appraisers, we are also experienced in providing federal estate tax appraisals for estates exceeding $12.92 million.

A personal property appraisal can be an important tool in your estate planning. Charities, family members and other beneficiaries often rely on appraisals for ensuring an equitable distribution of a decedent’s assets, such as an art collection or antiques. In situations where protected property is placed in a Trust during the lifetime of a designated beneficiary, personal property appraisals can provide a trust inventory, establish a step-up in basis or make an IRS charitable contribution.

We will work with your attorney to identify the objective and intended use of the appraisal, and then prepare the required documents.

Preparing and managing a divorce can be a complicated and difficult matter. Laws differ from state to state, but each partner is often entitled to some portion of all marital property. Distribution of marital assets requires a careful description and valuation of furniture, accessories, jewelry, antiques and other household items.

We can help by providing a careful inventory and accurate appraisal of your commonly held personal property. Your attorney will receive a thorough, objective appraisal report that meets the standards and guidelines set forth in the Uniform Standards of Professional Appraisal Practice. Our appraisals also satisfy the court’s requirements regarding court-ordered, equitable distribution. We can work with one or both parties if necessary, and we can be available for depositions and trial testimony should the case warrant it.

If you’re considering a tax-deductible, non-cash charitable donation; or if you need to file a casualty loss claim, we can assist you with a federal tax appraisal. As IRS-qualified appraisers, we are knowledgeable of the latest Treasury regulations and Internal Revenue Service requirements regarding the preparation and submission of personal property appraisals from a qualified appraiser.

If you need an appraisal to establish the value of a personal property item that is the subject of an insurance damage claim, we can help. Our appraisers provide replacement cost estimates for antiques, fine art, decorative objects and general household items that have been damaged by fire, smoke or water. If the objects have been totally destroyed or stolen, we can prepare a hypothetical appraisal to establish value (or loss of value) on a specific date.

We have be assisting policy holders, insurance companies, professional carriers and public adjusters in their efforts to settle outstanding claims for more than 28 years. In situations were outside expertise is required, we can also provide referrals to professional and licensed art conservators, restoration experts and authenticators in your area.

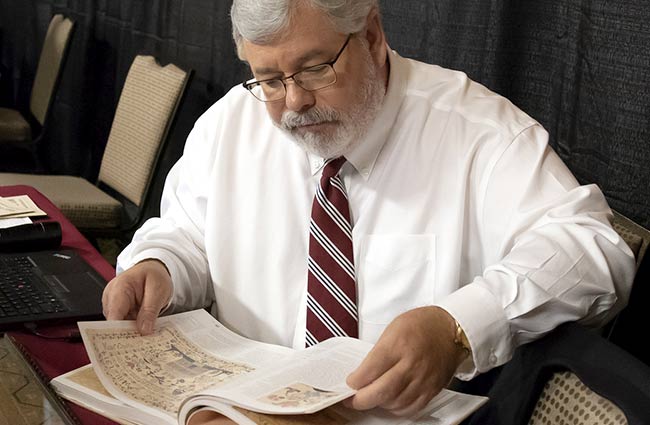

Our principal, C. Robert Harrison, is available for expert witness testimony and litigation support. He has provided appraisal reports for use in civil cases tried in both Maryland Circuit Court and DC District Court. As a litigation support specialist in appraising and appraisal methodology, Mr. Harrison has also assisted counsel with a review of pleadings and the preparation and review of questions used in interrogatories and depositions.

Contact us for more information.

*Notice: We are not a law firm and do not provide legal advice. As laws differ from state to state, you should seek the opinion of an attorney for advice on legal matters.

The Appraisal Process

Consultation

The appraisal process begins with a consultation to determine your specific needs. Whether settling a probate matter, scheduling family heirlooms for insurance purposes, making an equitable distribution or charitable donation of assets, we can provide you with an appraisal that meets your requirements.

Examination

Next, we will schedule an examination of your personal property. Objects are identified, described and photographed on-site according to their form, style, design, origin, artisan, period and provenance. When necessary, we can arrange authentication, videography or professional restoration services.

Market Research & Analysis

Following the examination, objects are researched in their most common market to determine their appropriate value or replacement cost. Value conclusions are derived from both realized sales and asking prices reported by auctions & art galleries, antiques shows, online resources, trade publications and expert consultations. We do not engage in educated guesswork. Our market research and analysis assures you an accurate, reliable appraisal of your collection, heirlooms and valuable items.

Appraisal Report

When a value conclusion is determined, it is explained in a clearly written and illustrated appraisal report based on the Getty Research Institute’s Categories for the Description of Works of Art (CDWA) and the Report Writing Standard of the International Society of Appraisers (ISA). You will receive two copies of the appraisal report.

The Appraisal Process

Consultation

The appraisal process begins with a consultation to determine your specific needs. Whether settling a probate matter, scheduling family heirlooms for insurance purposes, making an equitable distribution or charitable donation of assets, we can provide you with an appraisal that meets your requirements.

Examination

Next, we will schedule an examination of your personal property. Objects are identified, described and photographed on-site according to their form, style, design, origin, artisan, period and provenance. When necessary, we can arrange authentication, videography or professional restoration services.

Market Research & Analysis

Following the examination, objects are researched in their most common market to determine their appropriate value or replacement cost. Value conclusions are derived from both realized sales and asking prices reported by auctions & art galleries, antiques shows, online resources, trade publications and expert consultations. We do not engage in educated guesswork. Our market research and analysis assures you an accurate, reliable appraisal of your collection, heirlooms and valuable items.

Appraisal Report

When a value conclusion is determined, it is explained in a clearly written and illustrated appraisal report based on the Getty Research Institute’s Categories for the Description of Works of Art (CDWA) and the Report Writing Standard of the International Society of Appraisers (ISA). You will receive two copies of the appraisal report.

Frequently Asked Questions

While it is true that an auctioneer will sometimes offer prospective clients free “pre-bid estimates” for objects sold through the auctioneer’s establishment, an auction estimate is not an appraisal. A qualified appraisal prepared by an accredited and experienced personal property appraiser is an unbiased opinion of value. An appraisal is based on fact rather than guesswork, and it is prepared by a compensated professional who has no vested interest in the property being appraised.

Appraisers are expected to perform valuation services competently and in a manner that is independent, impartial and objective. Appraisers are bound by a code of ethics that prevents them from acting as client advocates. In other words, an appraiser cannot take sides or report predetermined value conclusions merely to please a client. Appraisers must report their findings in a balanced, accurate and truthful manner. Most importantly, professional appraisers cannot accept assignments, or be a party to a compensation agreement for an assignment, that is contingent on the amount of a value opinion or assignment outcome.

This is what separates the appraisal profession from the auction industry. While it is common practice for auctioneers to base their compensation on a percentage of a sale, an appraiser does not and cannot work that way. An appraiser cannot appraise “high” for insurance purposes, appraise “low” for estate tax purposes and then charge the client a percentage of the valuation. While it is perfectly acceptable for an auctioneer to arbitrarily inflate or deflate a presale estimate to stimulate interest in an upcoming sale, it is unethical for an appraiser to knowingly skew assignment results for a client’s benefit.

In short, an auctioneer is a commissioned sales person who offers “estimates” of what an object will sell for at their particular establishment. An appraiser offers unbiased opinions of value based on fact.

Most appraisal assignments consist of an on-site examination of the Client’s personal property, creating a photographic record of that property, conducting market research and analysis of comparable objects, and preparing a detailed appraisal report. In some instances, restoration and authentication of the objects are required.

It is unethical, misleading and potentially risky for an appraiser to offer a Client unconsidered opinions of value verbally or in writing. In order to determine the worth of any object, the appraiser must first understand the objective and intended use of the appraisal. Will you be insuring your property? Donating it to a charity? Selling it? The market conditions and final appraised value may differ in each case. You’re engaging the appraiser to research the appropriate market, analyze the results and provide an informed, professional opinion of value.

Accredited appraisers charge a fee that is consistent with that charged by other professional service providers. These include attorneys, doctors and financial advisors. And like other professionals, qualified and accredited appraisers charge by the hour.

The benefit of retaining a qualified appraiser can be seen in his or her work product. A professional appraisal report, written by an educated and experienced appraiser, is based on extensive product knowledge, market data research and careful analysis.

An appraisal report is not a laundry list of items prepared by the local auctioneer who agrees to value an entire estate or lifetime collection for only $200 or $300.

You will receive two copies of a written appraisal report that includes the following:

- A statement of the objective and intended use of the appraisal.

- A detailed object description and narrative analysis of the subject property, including its age, history, maker, materials, dimensions, and condition.

- An explanation of the methodology employed by the appraiser.

- A list of comparable objects used in the appraisal report, and where those comparables were obtained.

- A signed statement that the appraiser has no current or future interest in the appraised object and that the appraisal report conforms to the standards and procedures of the Uniform Standards of Professional Appraisal Practice (USPAP).

- A clearly stated value opinion or replacement cost.

- The effective date of the appraisal.

- The appraiser’s professional qualifications.